Should I Set Up A 401(k) For My Business?

- Castle Hill

- Nov 15, 2018

- 1 min read

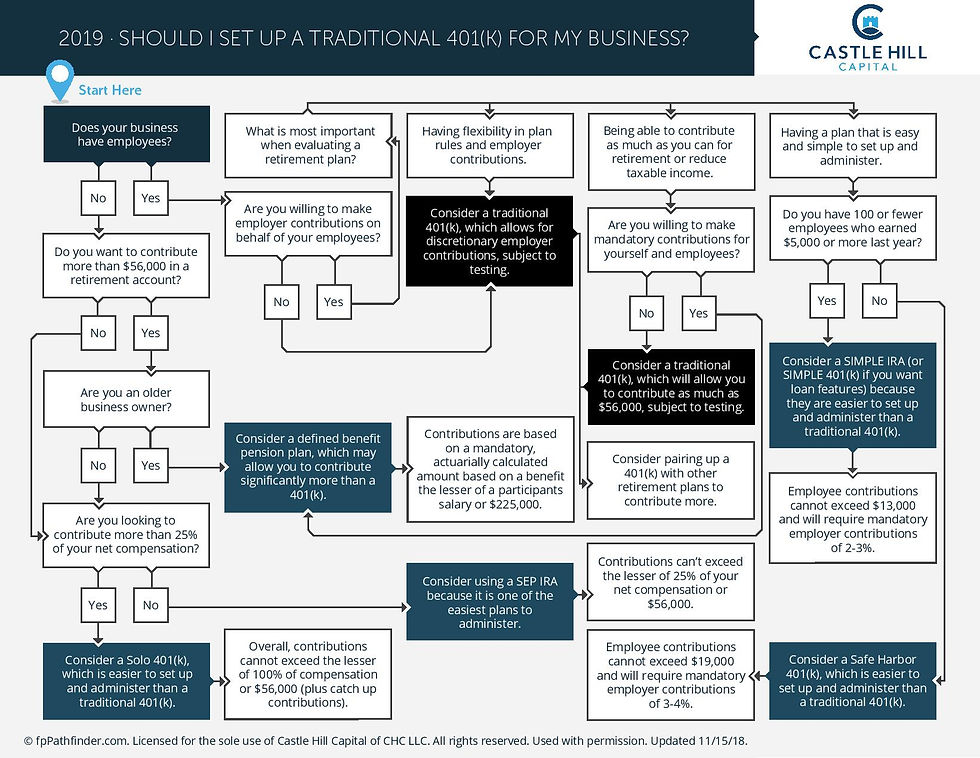

Business owners who are considering a retirement plan for their business have many options. While a traditional 401(k) is a well-known option among business owners, there are many cases where other retirement plan options may be better suited for the business and the owner. This flowchart addresses some of the most common issues that arise for a business owner looking to set up a retirement plan for his or her business such as:

Which plans may be better when there are no employees

When a defined benefit pension plan could be set up

Options to review when the goal is to contribute more than $55k per year

Maximum employee contribution amounts for plans

Which plans have mandatory matching contribution requirements

Minimum employer matching contribution amounts

Plans that have more flexibility

Updated for 2019

If you have questions about setting up a 401(k) for your business please get in touch with us here.